The trade was originally opened using a sell to open transaction order by which you sold a call or a put. Once this has been done fidelity will close your account;

2

Like the buy to open order, the buy to close order is used to purchase options contracts, as opposed to the sell to open order or the sell to close order, which are both used to sell options contracts.

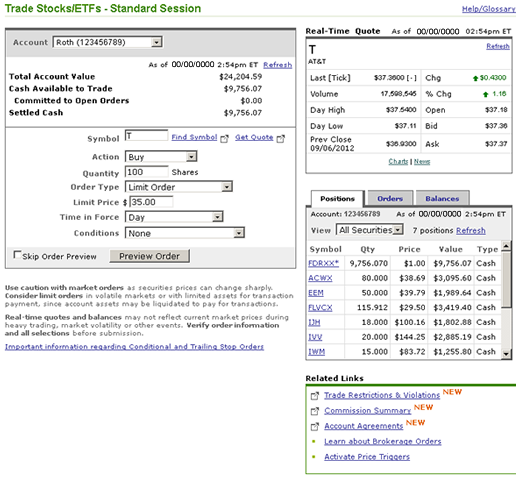

Buy to open vs buy to close fidelity. When you buy to open an option and it creates a new position in your account, you are considered to be long the options. Get yourself to the account features page. Buying or selling stocks and etfs at zackstrade will cost you $0.01 per share with a $1 minimum per trade.

After selecting which security you wish to trade and its corresponding option, you are presented with two ways in which to open that trade: Buy 10 xyz jan 20 calls at $1; And there youll have an opportunity to apply for the higher level.

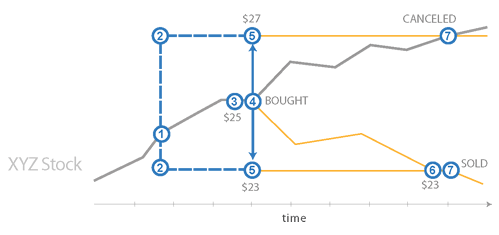

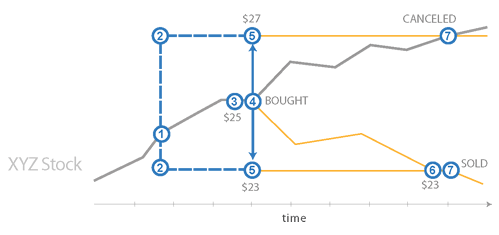

You only have level 1 option approval. 1) close it with an offsetting trade 2) let it expire worthless on expiration day or, 3) if you are long an option you can exercise it. 'buy to close' refers to terminology that traders, primarily option traders, use to exit an existing short position.

Once you are long or short an option there are a number of things you can do to close the position: You are buying the option to open the. There are several brokers that are competitive with fidelity's quality, pricing, and services, and may even perform better in some areas.

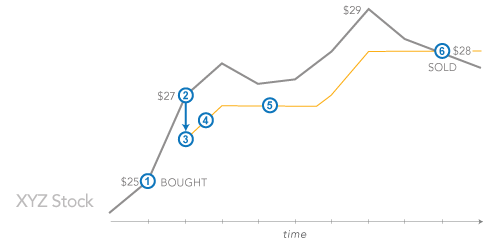

You want to select buy to open when you are going long on an option. As discussed in the previous section, the sell to open order is used to sell new (write) options contracts. Cost = 10 (number of contracts) x 1 (option price) x 100 (option multiplier) = $1,000.

For a small fee, fidelity will make trading decisions, hopefully with better results. The difference is buy to close is usually for options and sometimes for futures, whereas buy to cover is only for stocks. To close your account you need to make a full withdrawal or move all of your holdings to another provider.

The buy to close transaction order is used to close out an existing option trade. To close the short stock position, youd buy the stock. sell to open or buy to open.

Are fairly close to those in the u.s., and generally documentation for proof of address and proof of identity is required. Long 10 xyz jan 20 calls The phrase buy to open refers to a trader buying either a put or call option, while sell to open refers to the trader writing, or selling, a put or call option.

How this is done depends on what instruction has been received. Which would be the ability to sell to open a covered call and buy to close a covered call. buy to close is how you exit a short contract position.

Short sales involve selling borrowed shares that must eventually be repaid. It costs 35 basis points per annum. When you make a full withdrawal the account will stay open for 12 months to allow for any residual dividend payments.

You can place on the close orders for a minimum of 100 shares before 3:40 p.m. sell to close is when. I want to show you how simple invest.

You need level 2 for buy to open. Nasdaq does not accept on the close orders. In comparison, the sell to close order is used to sell an existing options contract that you already own and it is used for both call and put options.

Buy 10 xyz jan 20 calls at $1; When you buy to open an option and it creates a new position in your account, you are considered to be long the options. Then you will buy back (buy to close) the short call for $105, and sell (sell to close) the long call for $155.

Buy it or sell it. You can instead open a short position by either selling borrowed securities or taking the sellers side of a contract. Penny stocks (defined as anything trading below $1 per share.

Cost = 10 (number of contracts) x 1 (option price) x 100 (option multiplier) = $1,000. You cannot specify on the close on stop orders, or when selling short. 'buy to close' is used when a.

Requirements for opening account outside of the u.s. In todays video, i am going to take you with me as i open an account at fidelity and invest $100 in 5 different stocks. For instance, ally invest charges $9.95 for all mutual fund trades.

The buy to close is one of the four main types of options order that can be used to trade options contracts. At the bottom of the price range is a robo program. When you open an option position you have two choices:

If you're closing a fidelity account, you may be interested in finding a replacement. Long 10 xyz jan 20 calls In this example, your loss is $150:

However, they both result in buying back the asset you originally sold short, meaning you end up with no exposure to the asset. The actual orders used would be buy to open or sell to open. Youll see you have level 1.

Buy to cover is a trade intended to close out an existing short position. Before expiration, close both legs of the trade. When going long on either a call or put option you dont need any stock or funds to back up the position.

How to close fidelity account online Fidelity customers who fail to achieve the investment results theyre looking for can instead open one of the brokers managed accounts.

Fidelity Review 2021 - Pros And Cons Uncovered

Trading Faqs Placing Orders - Fidelity

How To Buy A Stock At Fidelity With Screenshots - The Wall Street Physician

Read This Before Buying Fidelitys Zero-fee Funds The Motley Fool

Trading Faqs Order Types - Fidelity

Trading Faqs Order Types - Fidelity

Fidelity Review 2021 - Pros And Cons Uncovered

Fidelity Short Selling Stocks How To Sell Short 2021

Fidelity Hidden Fees 2021

Fidelity Extended Hours Trading Pre Market After Hours 2021

Trading Faqs Placing Orders - Fidelity

Fidelity Extended Hours Trading Pre Market After Hours 2021

/Fidelityvs.T.RowePrice-5c61be6e46e0fb000110647b.png)

Fidelity Investments Vs T Rowe Price

How To Sell Calls And Puts Fidelity

Fidelity Penny Stocks Fees Rules Otcpink Sheets Trades 2021

Fidelity Go Review Smartassetcom

How To Execute Options On Fidelity - Youtube

How To Buy A Stock At Fidelity With Screenshots - The Wall Street Physician

How To Trade Options On Fidelity - Youtube

Buy To Open Vs Buy To Close Fidelity. There are any Buy To Open Vs Buy To Close Fidelity in here.